China bond market has seen extraordinary rise in recent years and with approx 13 trillion in dollar terms it has become the second largest bond market in the world. Earlier this year, Barclays Global Aggregate Index included China Government Bonds (CGB) and policy bank notes into the benchmark. Foreign institution is now permitted to actively participate in the market. Some 1800 foreign investment institutions participate in the interbank market with holding exceeding 2,000 billion RMB. Monthly net investment has reached 100 billion RMB, and in terms of volume, the yearly trading volume for 2019 is projected to exceed 4000 billon RMB.

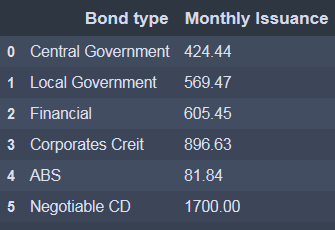

Looking at the overall China bond market in numbers. In the month of August 2019, total issuance is about 4,400 billion RMB:

In the intrabank market, the daily volume of bond trading in August was 912 billion RMB; in the exchange market, the daily volume was about 751 billion RMB.

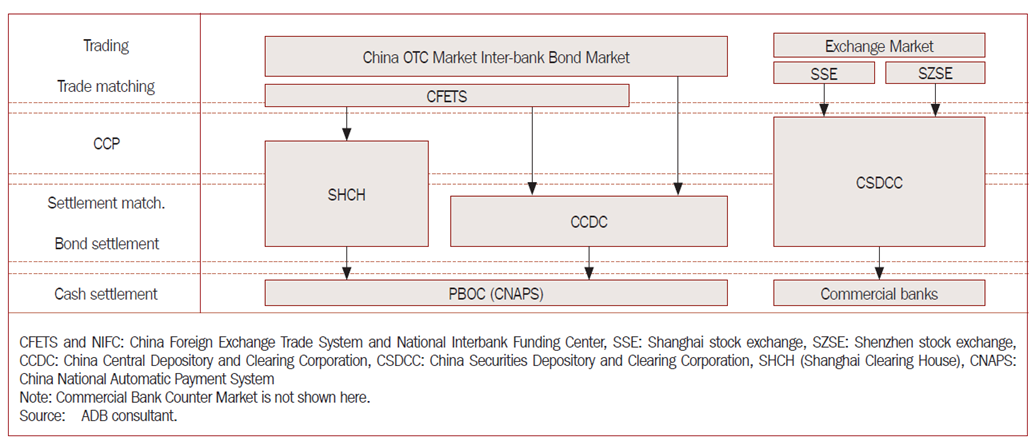

The organisation of the market

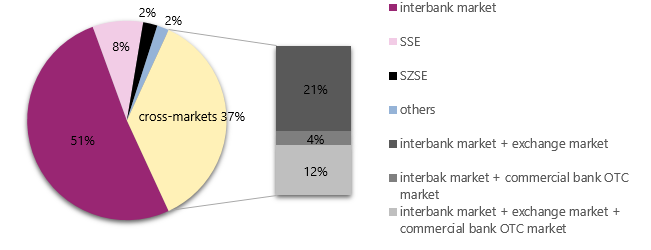

China’s bond market is comprised by of an OTC market and exchange market. The OTC market includes an interbank market and commercial bank OTC market, and the exchange market consists of the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE).

Bond Yield Curves

Today we will dig a bit deeper into the valuation of Chinese bonds. The different types of bonds, by local convention, are broadly be categorised into Interest Rate Bond (including Treasury bonds, local government bonds, central bank bills, policy bank bonds, and government-backed agency bonds) and Credit Bond (including financial bonds minus the policy bank bonds, plus corporate credit bonds). By some definition bonds issued by commercial banks belong to the formal category; others may consider them as credit bond. Existing investments by foreign investors mostly concentrate on the Interest Rate bonds, and including commercial bank Negotiable Certificate of Deposit (NCD).

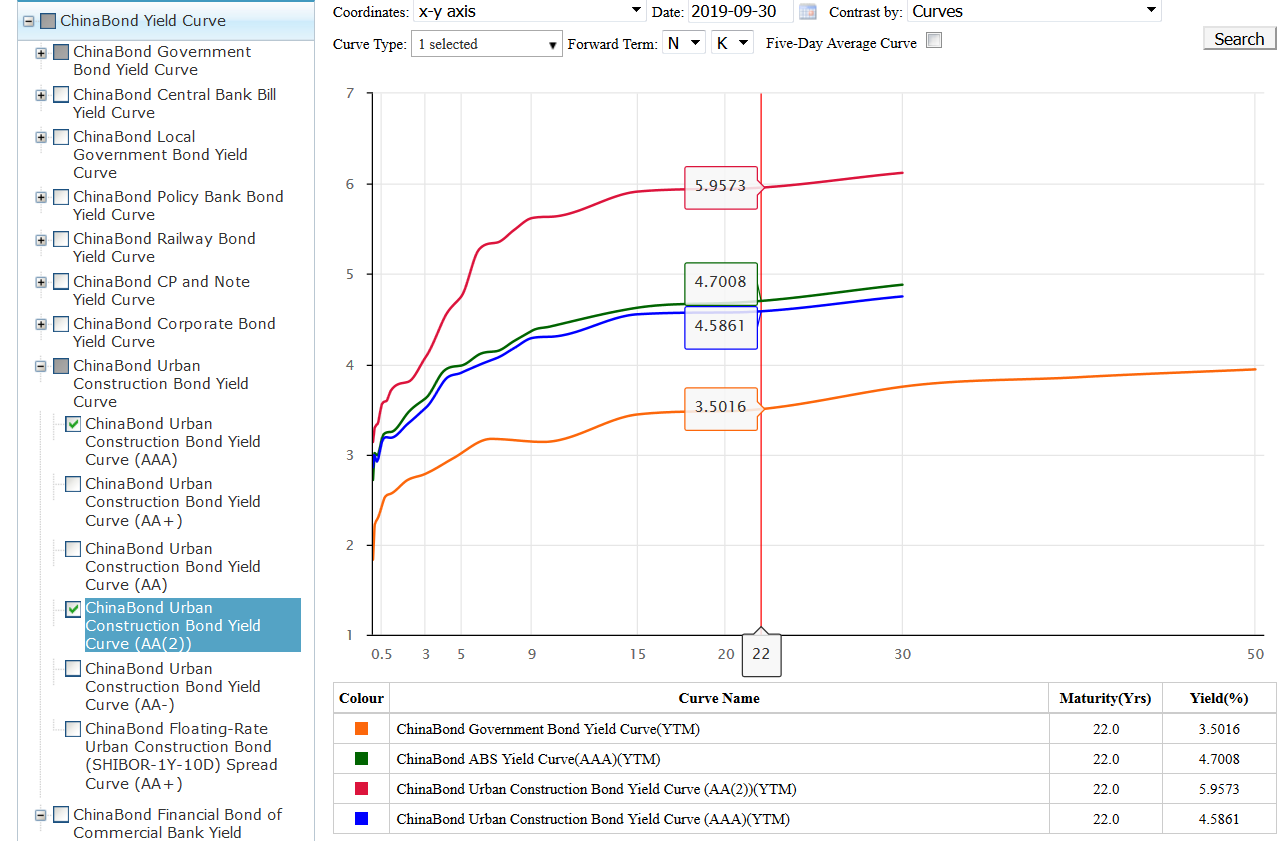

In the interbank market where bulk of the trading takes place, a series of yield curves are published by the Clearing & Depository Corporation (CCDC) and CFETS, which together make up the the trading and settlement platform for interbank market.

Both yield to maturity (YTM) and spot curves are published. So to value a bond, we map to the relevant curve based on the bond type and rating where applicable, and either look up the price from the YTM curve based on the remaing maturity, or through discounting the cash flows using the spot curve.

Using these rating curves, it allows to assess the credit spread risk of the issue, separating out the credit risk premium from the pure interest rate of risk of treasury bonds. To adjust for taxation, the credit spread is typically calculated against policy bank CDB bond instead of treasury bonds.

Assessing the credit risks in the valuation

This bring another question: how much can we trust the ratings? Subject to regulation and issuance constraints, the initial credit ratings of bonds and issuers are generally between AAA and AA. On average in China, for the same pool of issuing entities, the credit ratings assigned by domestic rating agencies are 5 sub-notches higher than the ratings assigned by international agencies. How much does the price reflect the credit quality of the issue? Well the answer is mixed. Earlier I mentioned that issues by commercial banks can arguably be categorised as Interest Rate Bond. Lets look at a recent example.

Defaults are now a active concern for investors especially after a few episodes of government intervention of rural and city commercial banks. BaoShang Bank was the first in the list in 2019.

Through out the months leading up to the government seize, the bank maintained a major rating agency rating of AA+, all the way up to end of May when the government forced the administration of the bank by China Construction Bank. The cost the bank's borrowing in the interbank market also showed no fluctuation throughout. So for these small commercial banks, ratings are irrelevant and does not correlate to the soundness of the banking operation. The onus is on the government to bail them out at time of distress.

Beyond Rating

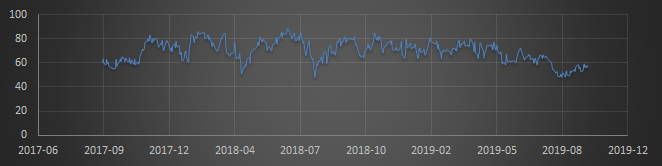

At the same time, rating agencies themselves are under scrutiny, throwing the trustworthiness of ratings further in doubt. To improve the risk projection and management of the bond investments, one has to look beyong rating, like for example, sentiment analysis.

A quick backdated google for the period leading up to the BaoShang distress showed that sentiment analysis would have picked up the early warning signals long before rating agencies.

Summary

- In the low rate environment of the markets, the China bonds' comparative high yield are attracting foreign investors.

- It is a fast growing market with mature infrastruture and comprehensive tools for valuation.

- Ratings alone either at entity or issue level are not sufficient to gauge the credit risk in the bonds. Those should be supplemented with advanced analysis such as sentiment analysis etc.